Authenticalls introduces Biometric e-Signatures with Pre-KYC validation - built directly into your sign-up flow as a single, frictionless step

The results speak

Nigeria

A mobile wallet cut fake signups by 42% in 60 days, saving $120,000 per quarter.

Kenya

A microlender reduced loan defaults by 27% after duplicates were blocked.

South Africa

An insurer eliminated 18% of fraudulent claims, saving $2M annually.

Pan-African crypto exchange

Reduced AML alerts by 31%, improving compliance credibility.

East Africa (BNPL)

Fraud reduced by 35% in 3 months

African fintechs face high onboarding fraud. Traditional KYC is reactive, costly, and allows bad actors inside before they are detected.

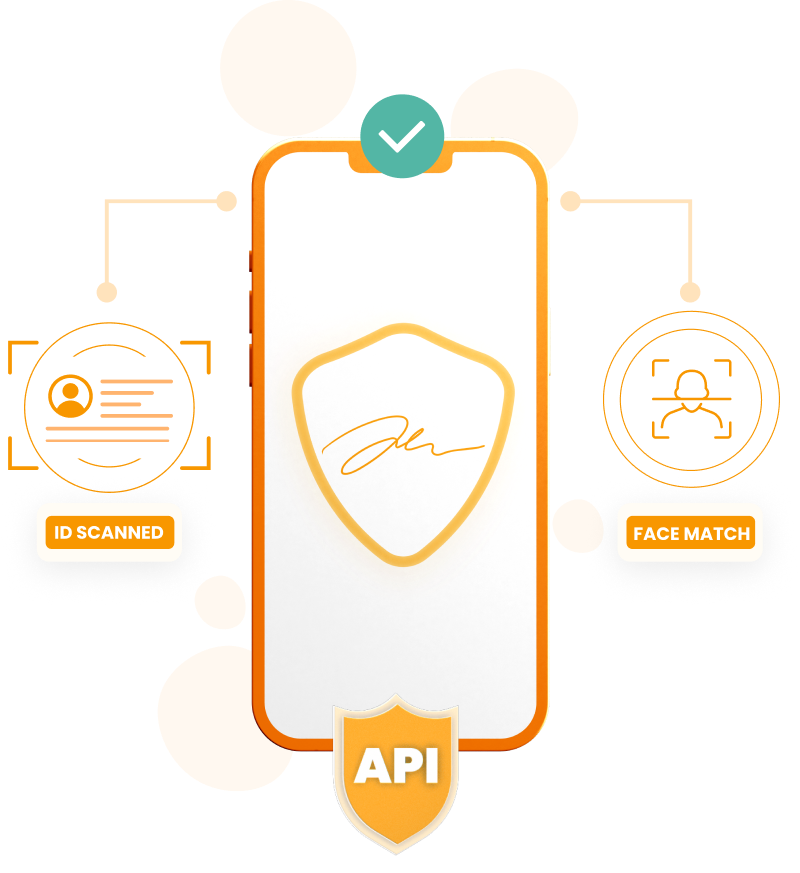

Users sign holographically on-screen (once).

ID is verified against customer data.

Face is matched to the ID, with a liveness check.

A legally valid digital signature is generated, tied to that verified identity.

Proven Results Across Africa

In 2024, Authenticalls helped fintechs in Nigeria, Kenya, South Africa and Ghana save more than $7.2 million in fraud and wasted KYC checks. In 2025 (so far), companies in 10 countries across Africa are on track to save over $15 million, thanks to Authenticalls' Pre-KYC e-Signature system.Real impact: One step in signup → millions saved annually.

Get the Whitepaper

Reduce FRAUD, speed up ONBOARDING, and convert MORE USERS. Read the Whitepaper to see how Authenticalls helps operators and fintechs transform compliance into growth.

Why it matters

Fraudsters exploit promotions, loans, and stolen IDs.

Traditional KYC lets them in before stopping them.

Authenticalls blocks them at the signup gate — before they cost you money.

How it works (inside signup)

- User signs on-screen → holographic signature captured.

- ID is scanned → data validated.

- Face is matched to the ID + liveness check run.

- Authenticalls returns a verified signature + ID via API.

- Signup continues seamlessly → user is already pre-KYC’d.

One extra step, one-time only, zero friction.

Key advantages for fintechs

Fraud eliminated at the gate.

One step = signature + KYC.

Legally binding e-signatures.

Fully API-driven and automated.

Mobile-first, built for Africa’s high-fraud markets.

Frictionless SignUp — just one simple step, only once.